Taking Social Security But Still Working with Eddie Holland

These days, more workers are opting to stay on the job after signing up for Social Security.

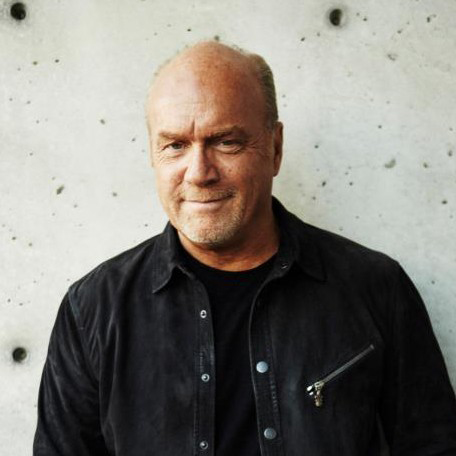

The percentage of Americans over 65 who are still working has doubled since 1980. Of course, many of them also get security benefits. Eddie Holland is here to explain how working affects the monthly benefit check.

Eddie Holland is a Senior Private Wealth Advisor and partner of Blue Trust in Greenville, South Carolina. He’s also a CPA, a Certified Financial Planner (CFP®), and a Certified Kingdom Advisor (CKA®).

The Impact of Earnings on Social Security Before Full Retirement Age

If you begin drawing Social Security before reaching your full retirement age (FRA) and continue working, your benefits may be subject to an earnings test. Here’s how it works:

- Under Full Retirement Age: For 2024, the income limit is $22,320. If your earnings exceed this limit, Social Security reduces your benefits by $1 for every $2 earned above the threshold.

- Year You Reach Full Retirement Age: The earnings limit increases to $59,520, with a reduced penalty of $1 for every $3 earned above the limit.

- After Reaching Full Retirement Age: Once you reach FRA, there is no longer an earnings limit, and your benefits will not be reduced regardless of your income.

Will You Get Reduced Benefits Back?

A key point is that if your benefits are reduced due to exceeding the earnings limit before reaching FRA, those reductions are temporary. Once you reach full retirement age, the Social Security Administration recalculates your benefit amount, potentially increasing your monthly payment to compensate for the prior reductions.

After reaching full retirement age, you can increase your Social Security benefit through continued work. Social Security calculates your benefits based on your highest 35 years of earnings. If your current income is higher than one of the years included in your "high 35," the Social Security Administration will adjust your benefit amount the following year, reflecting your new earnings record.

Understanding Tax Implications

Social Security benefits may be subject to federal taxes, depending on your “combined income”—a calculation that includes your adjusted gross income, tax-exempt interest, and half of your Social Security benefits. Here’s a quick breakdown:

- No Tax: Social Security benefits are not taxed for single filers with combined income under $25,000 and married couples under $32,000.

- Up to 85% Taxable: For single filers earning over $34,000 and couples over $44,000, up to 85% of Social Security benefits may be taxed.

One strategy for reducing taxes on Social Security benefits, especially for those 70½ or older, is using a Qualified Charitable Distribution (QCD). This allows individuals to transfer up to $100,000 per year directly from their IRA to a charity, which can count toward their required minimum distribution and is excluded from taxable income. It’s a great way to support causes you care about while managing your tax burden.

If you plan to work while receiving Social Security benefits, understanding how income limits and taxes affect your benefits is crucial. These guidelines can help you make informed decisions about when to claim benefits and how to maximize your income.

On Today’s Program, Rob Answers Listener Questions:

- I received insurance death benefits, and my sister also and I received insurance death benefits. Are they subject to tithing? What’s the Christian perspective on this?

- I'm a single mom making $45,000 a year as a chaplain. I also have to financially support my mom, who is not good with finances. It's frustrating because she can't get ahead, and I'm worried about our future and preparing for my daughter and myself. Do you have any suggestions on how I can help my mom with her finances?

- My husband and I have looked into Christian Community Credit Union. You've talked about them before, but we noticed they are not FDIC-insured and wondered if that was a concern.

Resources Mentioned:

- BlueTrust

- Christian Community Credit Union

- Look At The Sparrows: A 21-Day Devotional on Financial Fear and Anxiety

- Rich Toward God: A Study on the Parable of the Rich Fool

- Find a Certified Kingdom Advisor (CKA) or Certified Christian Financial Counselor (CertCFC)

- FaithFi App

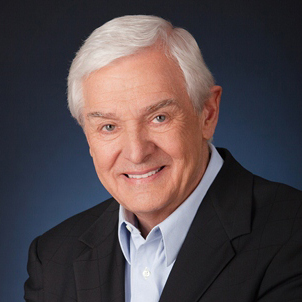

Remember, you can call in to ask your questions most days at (800) 525-7000. Faith & Finance is also available on the Moody Radio Network and American Family Radio. Visit our website at FaithFi.com where you can join the FaithFi Community and give as we expand our outreach.